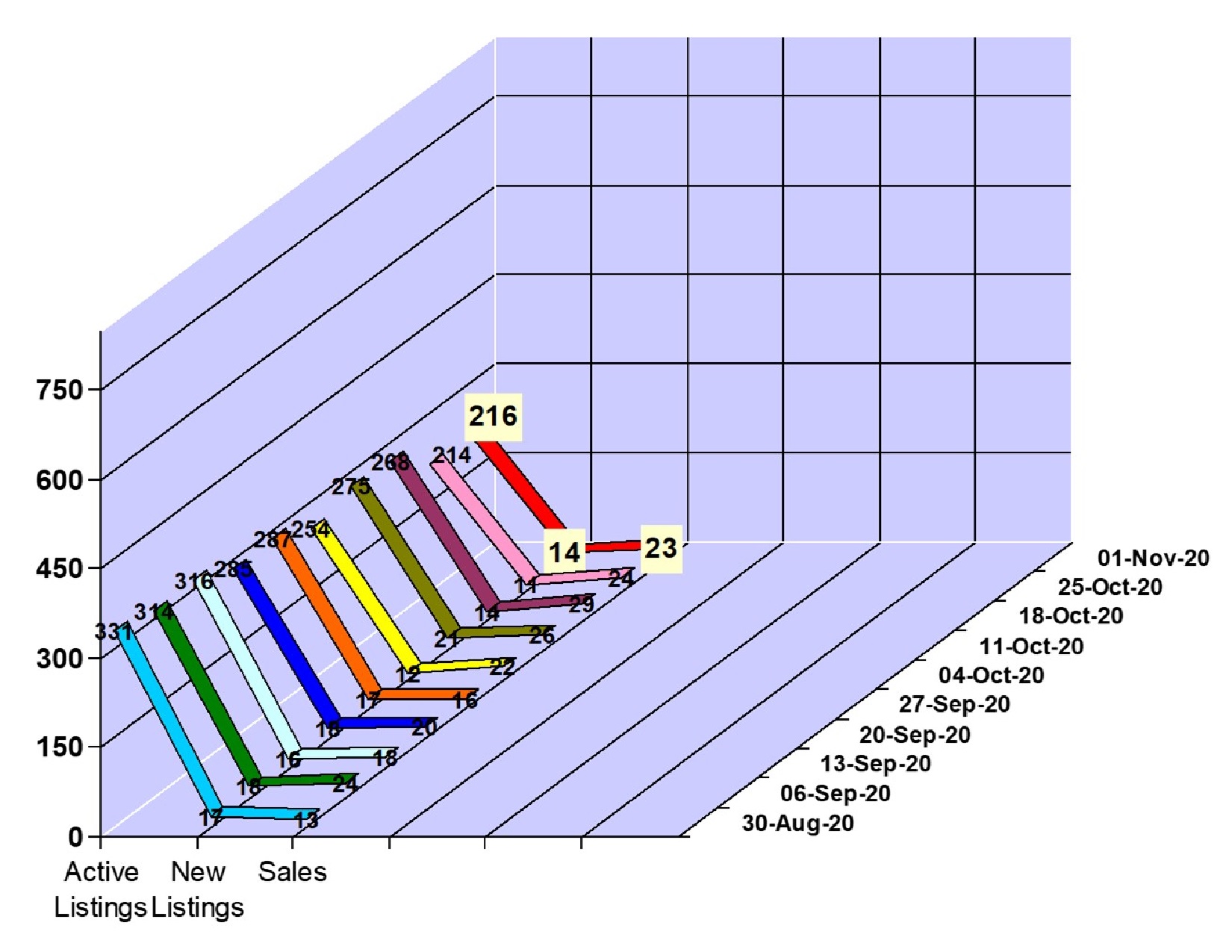

Whistler Real Estate | 23 Properties Sold

Sales for Week of October 26 to November 1, 2020

Whistler Chalet Property Sales: 2

Price Range: $2,750,000 to $3,325,000

Whistler Condo Sales: 8

Price Range: $129,000 to $1,390,000

Whistler Townhouse Sales: 12

Price Range: $836,000 to $2,795,000

Whistler Vacant Land Sales: 1

Price Range: $775,000

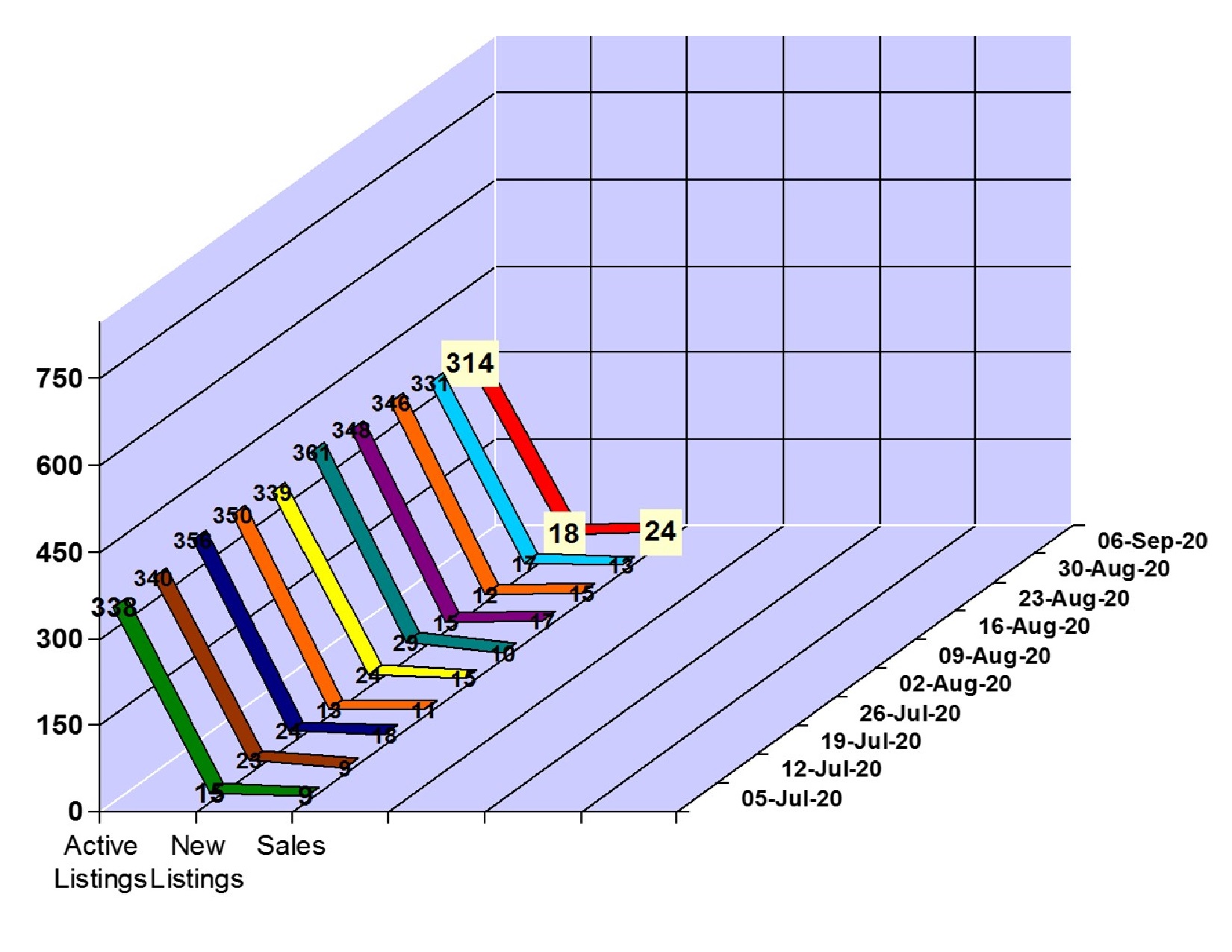

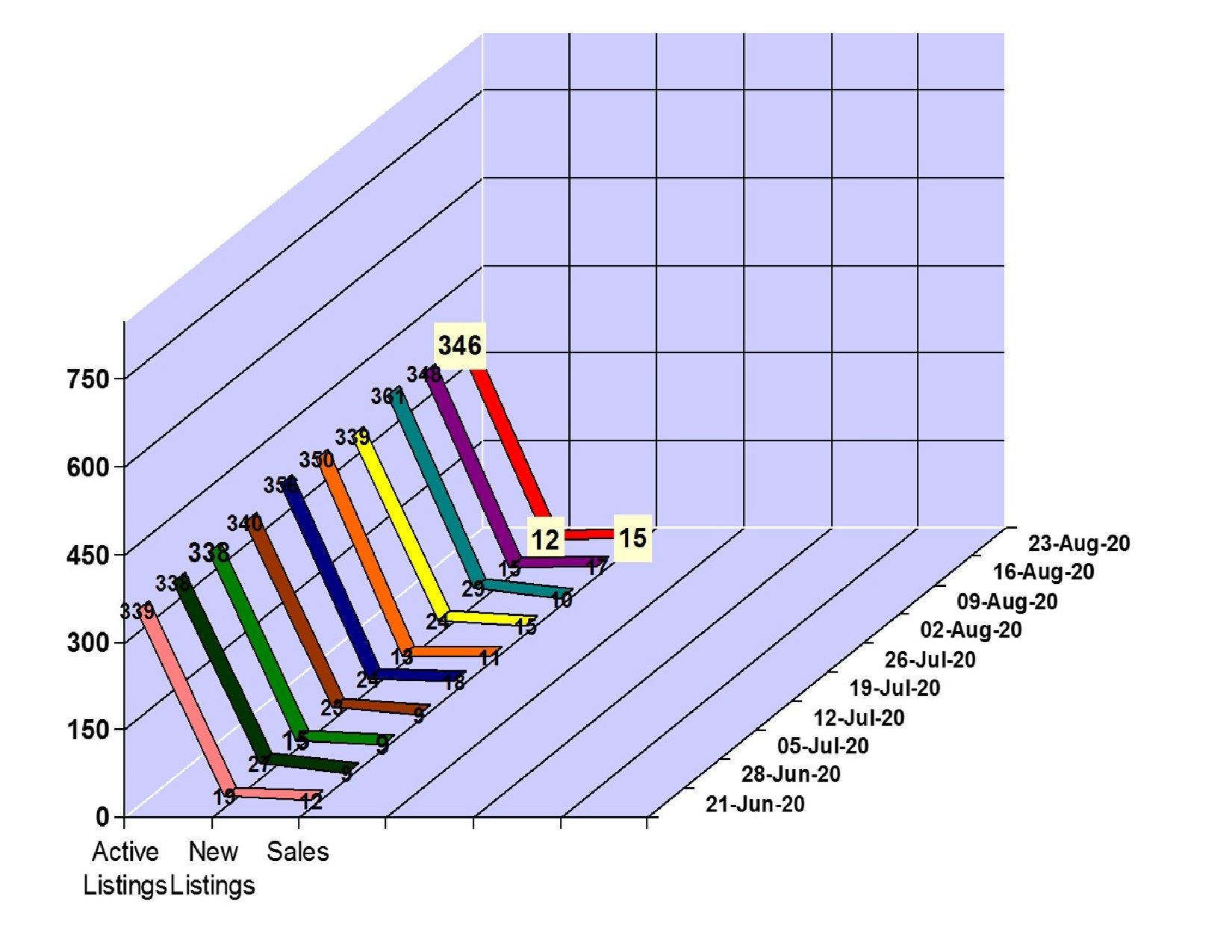

The entire month of October saw 20 plus property sales a week! 14 new property listings came on the Whistler real estate market. There are 216 active listings on the market. Click here to view the new listings for the week.

Do you have questions about the Whistler real estate market, please contact me here directly with them.